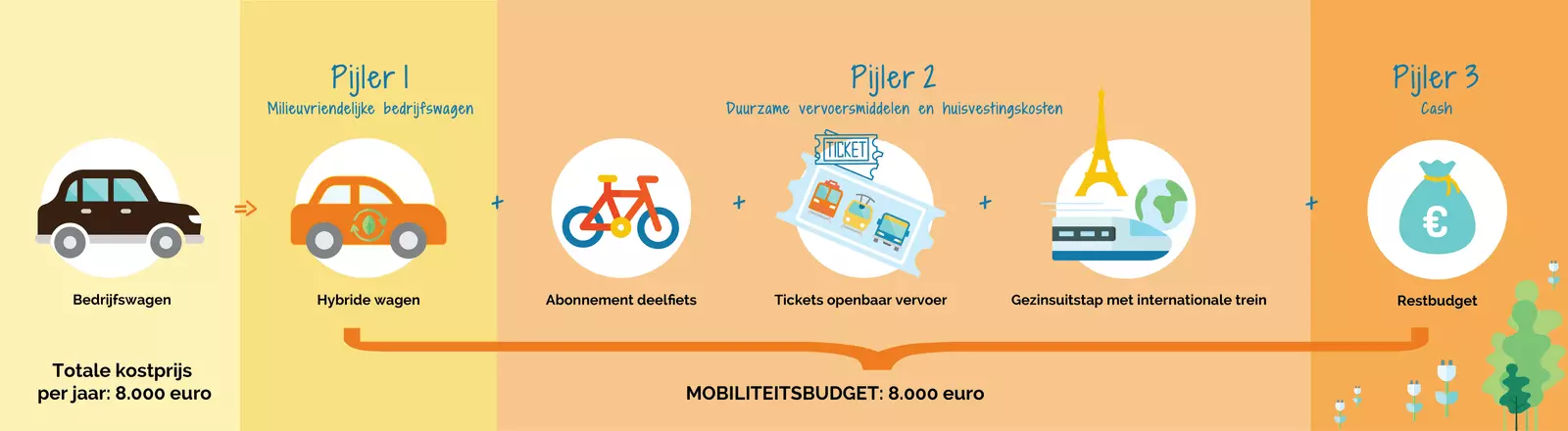

The mobility budget has recently received an update! The official website on the mobility budget has recently published a number of updates and clarifications that finally clarify some much-discussed topics! This brings long-awaited clarification for employers and HR professionals! In this blog, we give you an overview of what all has changed and clarified.

Bicycle allowance

The Belgian government has clarified that the legally defined bicycle allowance (0.25 EUR/km) for commuting can indeed be part of the mobility budget, "insofar as sectoral obligations do not prevent this." This means that the bicycle allowance can be integrated into the mobility budget and become part of the budget that an employee can spend in the three pillars of the mobility budget.

Exception: If the bicycle allowance was already paid up to 3 months before the implementation of the mobility budget, this allowance is not part of it.

For more info: https://mobiliteitsbudget.be/nl/5-waar-kan-je-het-mobiliteitsbudget-aan-besteden#keuzes

Distinction between employees

In the latest update, the Administration clarified that employers can indeed differentiate between different groups of employees and only allow certain mobility options for a well-defined group of employees.

More info: FAQ 5.26 https://mobiliteitsbudget.be/nl/5-waar-kan-je-het-mobiliteitsbudget-aan-besteden#duurzaam1

Purchasing means of transportation for others

Employees can use their mobility budget to finance sustainable means of transportation for people other than themselves. However, as far as subscriptions for public transport and company bicycles are concerned, you are limited as an employee. These cannot be purchased for anyone other than the employee himself or his resident family members.

More info FAQ 5.33 https://mobiliteitsbudget.be/nl/5-waar-kan-je-het-mobiliteitsbudget-aan-besteden#gezinduurzaamvervoer

Loans and interest

Interest and loans partially secured by a mortgage registration and partially by a hypotecary power of attorney can also be deducted in full from the mobility budget.

More info FAQ 5.45 https://mobiliteitsbudget.be/nl/5-waar-kan-je-het-mobiliteitsbudget-aan-besteden#Hypothecaireinschrijvingvolmacht

What is the normal place of employment?

According to the Administration, the normal place of employment is determined on a monthly basis. As a result, housing costs may therefore be reimbursed one month and not another through the mobility budget.

If there are multiple normal places of employment in the same month, the normal place of employment for that month refers to the place where the most hours of work were performed during that month

The employer is free to determine the best method of assessing the 10km rule.

More info: FAQ 5.48: https://mobiliteitsbudget.be/nl/5-waar-kan-je-het-mobiliteitsbudget-aan-besteden#woonplaatsinbrengen

FAQ 5.46 https://mobiliteitsbudget.be/nl/5-waar-kan-je-het-mobiliteitsbudget-aan-besteden#afstand5k

Minimum and maximum amount of mobility budget

The minimum and maximum mobility budget thresholds need not be verified each time there is a change in the employee's gross salary. The assessment of the mobility budget against those thresholds should only be done at the time of applying for the mobility budget or when the mobility budget changes due to a change in position or promotion.

More info: FAQ 6.5 https://mobiliteitsbudget.be/nl/6-hoe-groot-het-mobiliteitsbudget#wijzigingbruto

Part-time work does this adjust the amounts?

The TCO should be measured against the gross salary the employee would receive as a result of full-time employment. If the employee switches from a full-time to a part-time regime after the introduction of the mobility budget, this normally does not affect the amount of the mobility budget.

More info: FAQ 6.6 https://mobiliteitsbudget.be/nl/6-hoe-groot-het-mobiliteitsbudget#deeltijdstcobruto

Clarifications regarding fuel costs in the TCO

If fuel costs are included in the monthly lease price of the company car, they need not be added to the Mobility Budget.

Of course, this is not true if fuel costs are not included in the monthly cost of the lease.

At that time, the employee's total gross fuel costs during the year preceding the application for the mobility budget must be considered.

When using a reference company car, a reference budget for fuel costs must also be considered.

Since the mobility budget varies as a function of the employee's fuel costs, authorities accept that the reference budget varies as a function of the employee's commute under well-defined conditions (see FAQ 6.21).

If the employee works part-time, it is possible to prorate the reference budget for fuel costs.

Changes to the Car Policy.

If the car policy changes "en cours de route" and company cars with a lower budget (category) are proposed, this will not affect the employee with an existing mobility budget. The exception is if the budget change is related to a job change or promotion. The date of the mobility budget request is relevant here

More info: FAQ 6.32

Tax-free mileage allowance

New from 01.01.2023, if the employer grants an allowance for professional travel, it will be subject to NSSO and taxes.

Voilà now you are just like Payflip, all up to date!