Separately or in combination with a company car, mobility allowances or alternative mobility, it is also becoming increasingly popular to allow your employees to lease a bicycle through the company.

With bicycle leasing, as an employer you lease a bicycle of the employee's choice in exchange for part of his gross salary or budget in the cafeteria plan. Usually the lease period is 36 months, after which the employee can purchase the bicycle permanently for approximately 16% of the catalogue value.

Bicycle leasing gives you, as a company, the opportunity to take extra advantage of the personal mobility needs of employees, without pushing up the wage bill. Don't forget the mandatory bicycle allowance!

Impact on the portfolio

Bike leasing is a dream for an employee's wallet. Every cycling club has a member who has acquired an otherwise unaffordable racing bike through his employer.

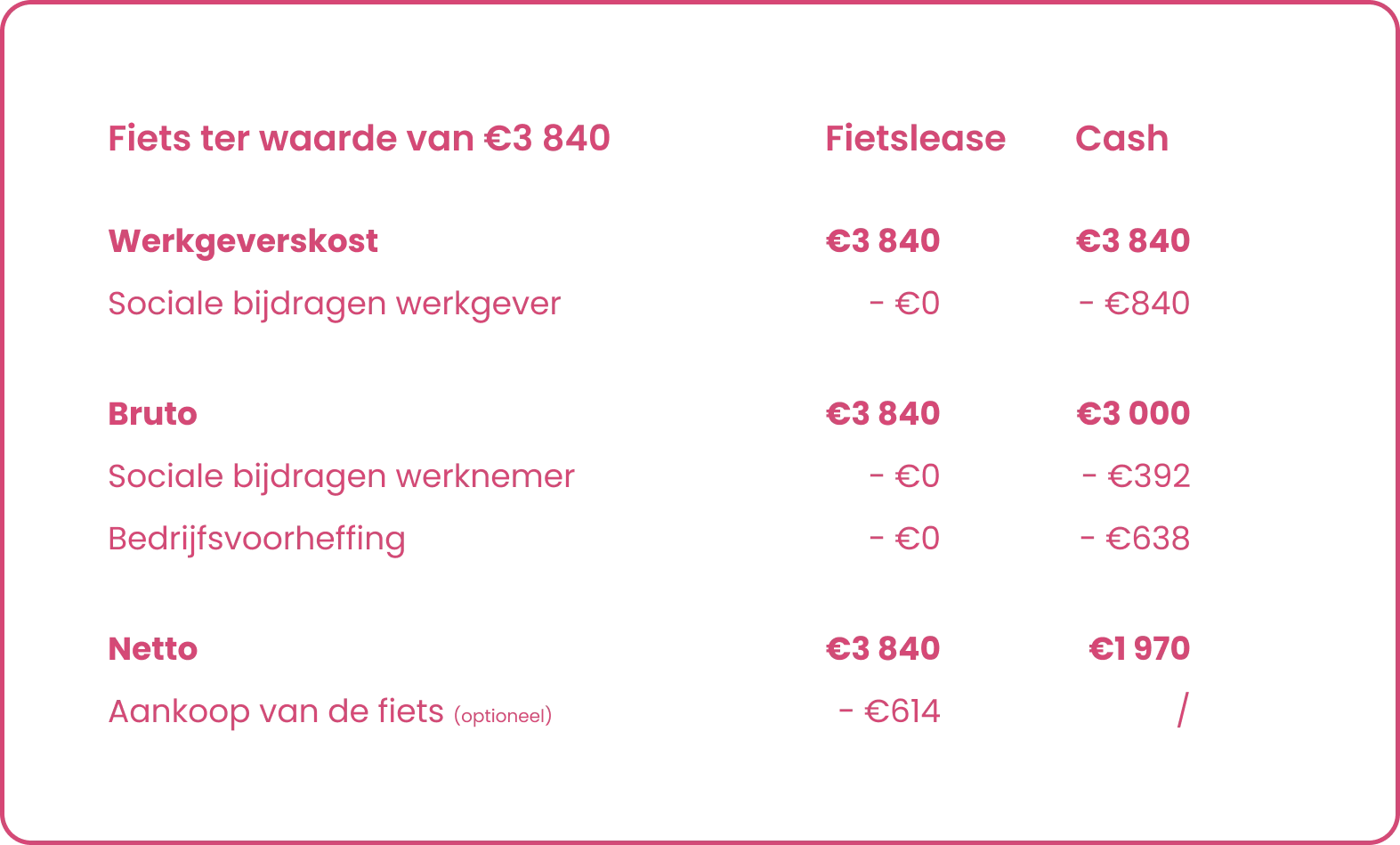

When looking at the taxation of a bicycle lease, this is not surprising. On a bicycle lease no employer contributions , social contributions or taxes have to be paid by the employee.

As you can see in the example below, the benefit of a bicycle lease for an employee is thus quickly huge.

(read more below the image)

What does the future hold for bicycle leasing?

In the future, too, we expect expansion rather than restriction of the possibilities of bicycle leasing.

In March, the Flemish government decided that civil servants at local and provincial administrations could voluntarily exchange part of their end-of-year bonus or their holiday for a bicycle lease in a tax-friendly manner.