It's not a secret anymore: a cafeteria plan is a must! In this client case about the cafeteria plan, you will quickly find out why a cafeteria plan contributes to the flexibility of your salary policy, but also what a cafeteria plan looks like (for our clients) in concrete terms. One important question remains: what is the best budget to use? "With the end-of-year bonus," is Payflip's decisive answer. The different reasons are listed below for you.

Reason #1: flexibilization of the end-of-year bonus possible thanks to sectoral collective bargaining agreements

From "cash" payment of the end-of-year bonus to flexibilization: an interesting evolution at the level of the joint committees and their sectoral agreements (or CLAs)...

In addition to determining the minimum wages (or "scales"), the joint committee also determines the end-of-year bonus (or "thirteenth month"). The Joint Committee determines whether or not it is mandatory to introduce an end-of-year bonus, the method of calculation, as well as the time and manner of allocation. Would you like to know more about the end-of-year bonus? Then first read our blog post on the end-of-year bonus.

The fact that the end-of-year bonus must be paid in "cash" is still the starting point for most joint committees. A payment of the end-of-year bonus in another way is therefore not possible. Given that sectoral collective agreements are higher up in the "hierarchy of legal norms" than, for example, an individual employment contract or an intra-company practice, an employer cannot deviate from paying an end-of-year bonus in cash.

However, in recent years there have been positive developments in making the end-of-year bonus more flexible! A number of joint committees allow for the flexibilization of the end-of-year bonus. This flexibilization is laid down in sectoral CLAs and provides that the (alternative) allocated benefits - in our case in a cafeteria plan - must be at least equivalent to the end-of-year bonus!

The largest joint committee in our country, Joint Committee 200, allows for flexibility in the end-of-year bonus. More than 400,000 white-collar employees can now put together their own tailor-made salary package! In addition to Joint Committee 200, other Joint Committees also allow for more flexible end-of-year bonuses:

- joint committee 201;

- joint committee 317;

- joint committee 110;

- joint committee 227;

- ...

Reason #2: The end-of-year bonus as an interesting budget

Belgium is part of the most heavily taxed countries in Europe. In particular, wages in our country are subject to high taxes. Nothing could be further from the truth with regard to the end-of-year bonus. In addition to the normal NSSO employee contribution (13.07%), the end-of-year bonus is subject to an exceptional withholding tax (up to 53.5%). This can be explained by the fact that the end-of-year bonus is regarded as an additional, exceptional wage component.

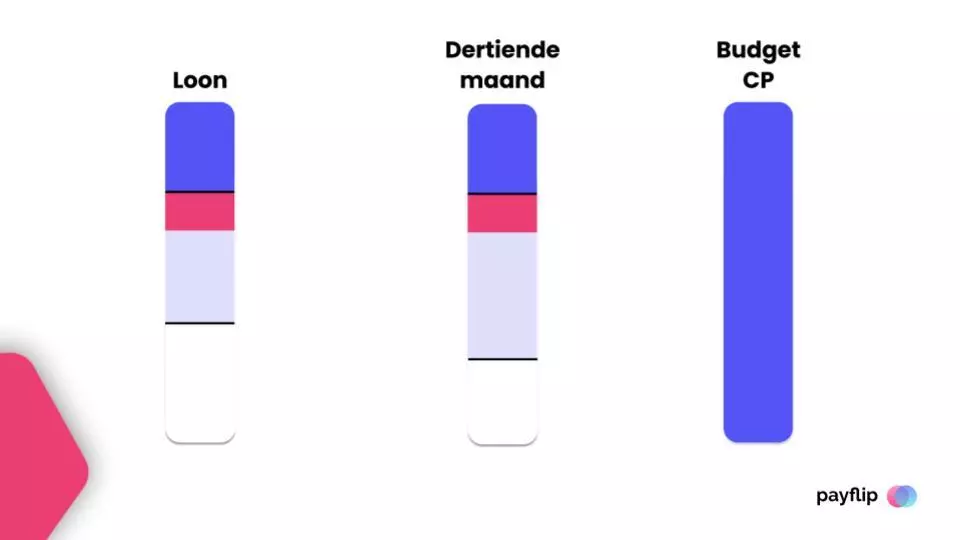

Compared to your gross monthly salary, you will have less net left over from your year-end bonus (some 70% goes to Father State)! 👇👇

What does the year-end bonus mean in the cafeteria plan?

Besides the fact that you will be able to do more with your year-end bonus (compared to a normal cash payout), you will also get more budget to spend on benefits! Why is this? One of the most important principles within the cafeteria plan is cost neutrality on the part of the employer. This means that the end-of-year bonus budget in the cafeteria plan boils down to the sum of the gross end-of-year bonus and the social security contribution (+/- 28%).

Concrete example: suppose you are entitled to a gross year-end bonus of EUR 3,000. The NSSO contribution of your employer is 28%. You will then be entitled to a budget of EUR 3,840. Top news, isn't it?