Absolutely! The premiums deposited in the context of individual pension savings can be (partially) reimbursed via the cafeteria plan. So a nice 'cash' advantage!

A word of explanation please!

Employees can opt for a refund of individual retirement savings (pillar 3) within the cafeteria plan. This choice provides employees with a refund of contributions made last year under an individual retirement savings plan (through their bank or an insurance broker).

Note that this type of retirement savings has nothing to do with statutory pension (pillar 1) or group insurance (pillar 2).

What is the financial benefit?

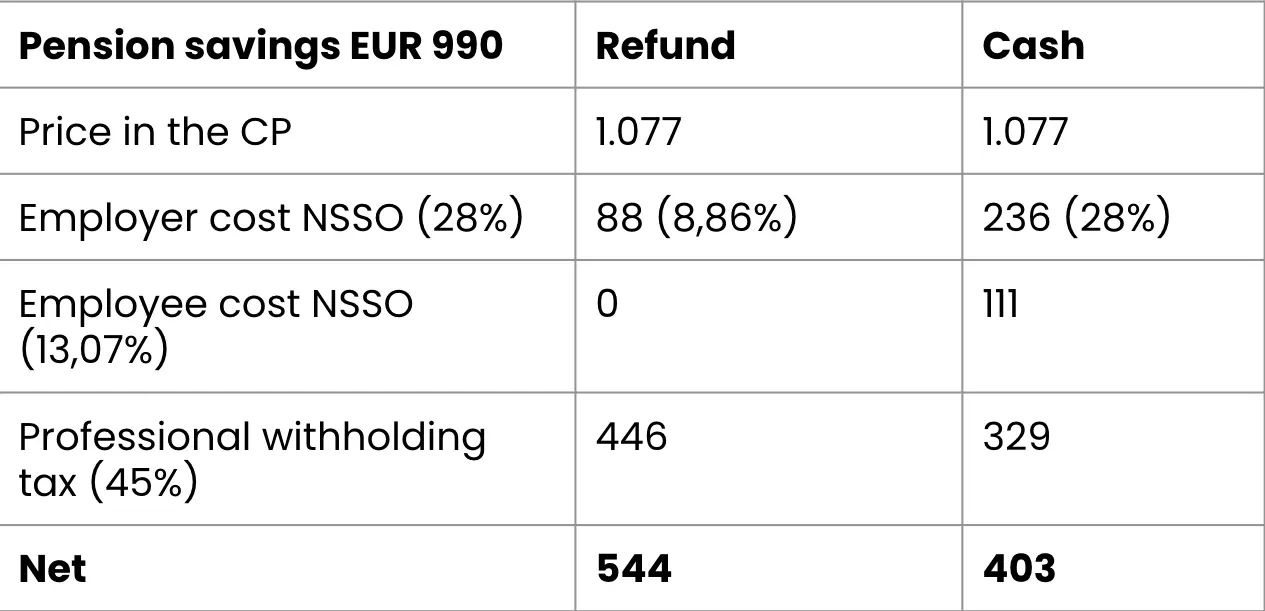

The reimbursement of individual retirement savings results in a financial bonus for the employee.

This is because of 2 reasons:

- The employer's social security contribution rate is only 8.86% (instead of the usual 28%).

- No social security contributions must be paid by the employee on this amount.

As a result, the financial benefit for a 990 euro refund can quickly add up to about 150 euros, compared to the cash payout of that same amount. An example below 👇

What are the rules?

Employees must provide proof of premiums paid (this can be bank statements or a tax certificate).

Practical Tips

Individual retirement savings reimbursement is incredibly popular with employees and could not be easier administratively! Highly recommended to include as a benefit in the cafeteria plan!

What if an employee resigns?

A layoff does not normally affect this benefit, as it would only be paid at the end of the year along with (the rest of) the end-of-year bonus anyway.