Do you sometimes wonder why your net wage is so much less than your gross wage? Or why employers often complain about the high 'labour cost' of their team? And what about all those extra-legal benefits? Payflip provides you with a clear answer below!

What is an employer's wage cost?

The 'wage cost' is the total cost that an employer pays when he pays you your monthly wage. This is not the same as the gross salary you receive every month.

On your gross monthly salary, the employer has to pay social security contributions (popularly called 'employer's contributions'). These social security contributions amount to approximately 28% of the gross monthly salary. This means that for every €1 000 that the employer wants to pay you as a gross salary, he pays an actual cost of €1 280.

What is the monthly gross salary?

The term 'gross salary' is often used as a reference amount when talking about the size of your salary. But the gross wage is not the amount you receive every month. After all, your employer will deduct 2 types of contributions from this amount: social security contributions for the employee and withholding tax.

How do I arrive at my monthly net salary?

First of all, the employer pays your social security contributions to the Belgian Treasury. For each employee, these contributions are 13.07% of the gross monthly salary. They are used to fund the treasury to pay other sickness, pension and unemployment benefits.

Secondly, the employer deducts the payroll tax from the amount that remains after the deduction of the social contributions (= 86.93% of the gross salary, the so-called "taxable salary"). The withholding tax is an advance payment on the annual income tax that the employee has to pay monthly. It is a percentage that varies according to the size of the gross salary and the family situation ('the strongest shoulders carry the most').

For example, a single employee with a gross salary of €4000 will pay approximately 30% withholding tax, and a married employee with a gross salary of €2500 will pay approximately 20% withholding tax.

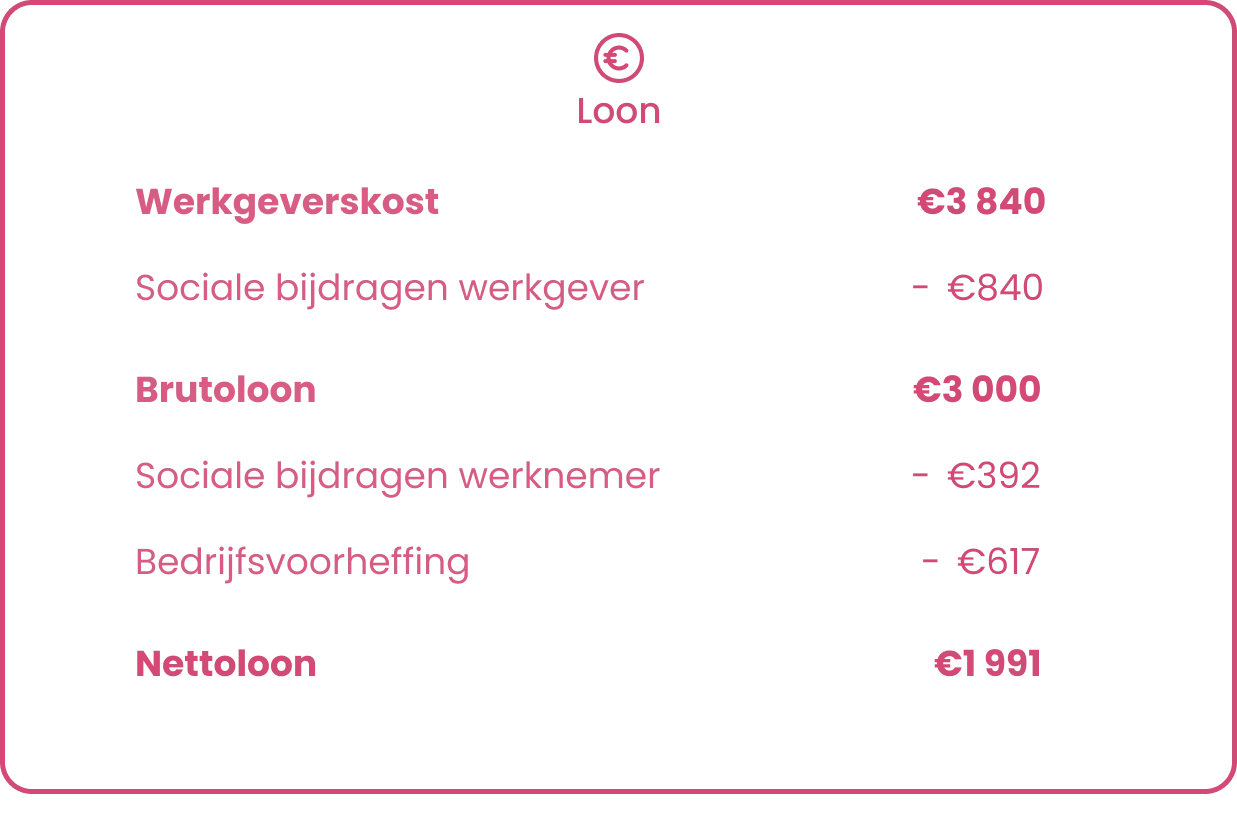

Numbers say it all

Because figures sometimes say more than words, we have worked out an example for you that clearly shows how your net salary compares with the wage cost of your employer for the same salary. You will see that your employer pays approximately double what you receive net as an employee!

We assume a monthly gross salary of €3 000 for an unmarried employee.

Why do I get (so many) other kinds of benefits besides my salary?

It should come as no surprise that the high charges on a gross salary prompt many employers to seek alternatives to the traditional gross salary in cash. That is why many companies choose to pay out extra-legal benefits . These are benefits that are not paid out in cash but in another way. Examples are: meal vouchers, eco vouchers, a company car, a company bicycle, hospitalisation insurance, etc.

The government decided to tax these extra-legal benefits a lot less and thus indirectly stimulate companies and employees to consume 'smart' in the field of health, food, environment,... That is why it is interesting to take out hospitalisation insurance through your employer.

Interested in smarter payroll? Feel free to contact us at info@payflip.be.