Most HR managers have heard of a cafeteria plan? But what is the impact in practice for my employees? And what does it actually look like in practice?

The first step in setting up the cafeteria plan is to create a budget for the employee.

As an SME, it is best to choose one budget that employees can spend. The very best option for this is the end-of-year bonus.

The end-of-year bonus, or thirteenth month, is an extra monthly payment that employees receive at the end of each year.

For the end-of-year bonus, there is an exceptional withholding tax rate that is higher than the withholding tax rate that normally applies to the basic monthly salary. This means that for most employees, there is only a small net amount left of their end-of-year bonus.

This makes the end-of-year bonus the ideal budget for a cafeteria plan. But what would the end-of-year bonus give in practice, if it were included in the cafeteria plan?

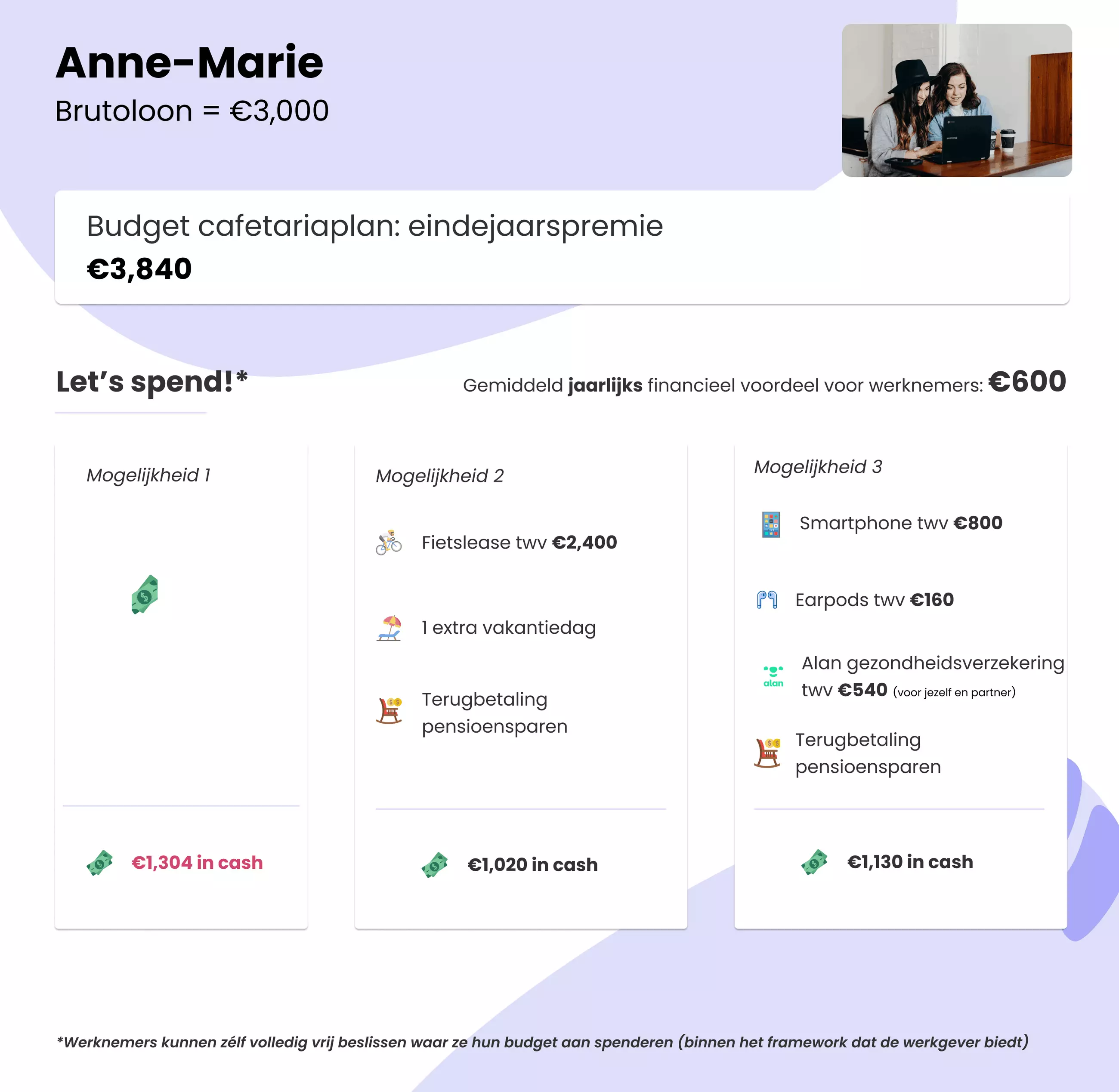

The budget

The cafeteria plan budget consists of the employer's cost of the end-of-year bonus. The employer contributions (approximately 28% of the gross end-of-year bonus) are thus added to the cafeteria plan budget. As a result, a gross end-of-year bonus of €3,000 quickly becomes a cafeteria plan budget of around €3,840.

Option 1

An employee can always opt for cash, also in the cafeteria plan. Therefore, an employee does not have to opt for extralegal benefits. As mentioned above, in addition to the normal social contributions, the employee pays an exceptional withholding tax rate of no less than 53.50%(!) This means that of the gross end-of-year bonus of €3,000, only around €1,304 remains in cash.

Option 2

An employee is completely free to choose what he/she considers important in the cafeteria plan. For example, an employee with a budget of €3,840 can choose:

- A bicycle lease worth €2 400

- An extra day of holiday that he can take during the year

- A refund of individual pension savings

- And the remaining amount in cash

Thus, in addition to a shiny bicycle and a well-deserved day off, the employee still receives a net cash sum of about €1 020 in December. So the employee only pays net about €300 for a bicycle and an extra day of holiday! 😍

Option 3

An employee can also make other choices:

- A smartphone worth €800

- Earpods worth €160

- Additional health insurance for self and partner worth €540

- A refund of individual pension savings

- And the remaining amount in cash

Thus, in addition to a brand new smartphone, cool airpods and a broader health insurance, the employee still receives a net cash amount of about €1 130 in December. The employee thus pays only €200 net for all these benefits!

Curious about the price of implementing a cafeteria plan with Payflip. Here you will find a handy overview of the prices of the cafeteria plan!